What does the bullshit economy tell us?

Today we are experiencing more of a bullshit economy than a real economy.

The advent of the IT-era has resulted in a lot of jobs being replaced, but also in a lot of new types of jobs being created. The pre-information-industrial economy provided value in tangible assets and associated services: real-world markets. The IT-era at first provided value in increased efficiency of these real-world markets, but as the virtual ecosystem expanded it has become increasingly more intrinsically value-driven. The financial sector is the most prominent example of this, where derivative market-value exceeds primary market-value by factors up to double digits.

Where the financial sector served as facilitating subsystem of a real economy, today it is the other way round: the tail has started to wag the dog.

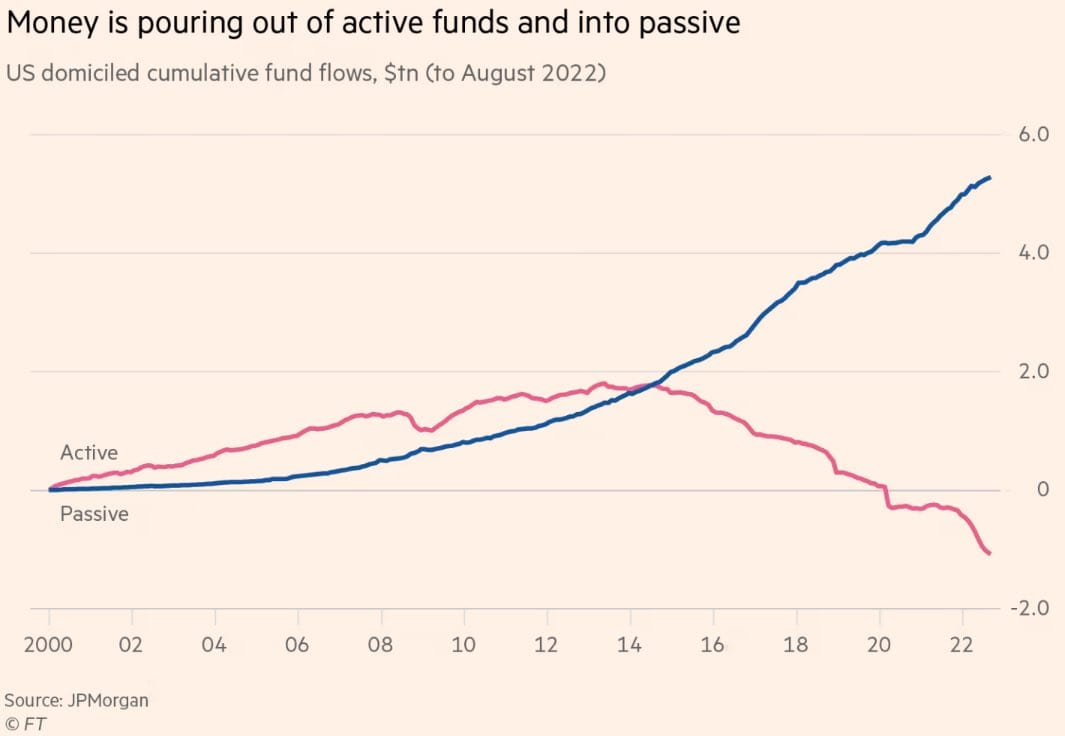

The increase in complexity of these financial markets and the regulatory increase in risk-mitigation have pushed this intrinsicality of value-creation beyond a tipping point: the trend towards passive investing has reached a point where there is more money allocated in passive funds than in active funds.

This is unprecedented and introduces systemic risk profiles into the global economy, which are hardly understood, and mostly even still unknown, especially in an environment that is still excessively overleveraged.

The depth of these synthetic markets has increased so much, that High Frequency Trading elements can even game these markets not only by clustering transactionality in the spatial dimension, but also in the temporal dimension.

Today, more than 80% of market volume is traded by HFT-elements. (https://archis.org/volume/volumes-archive-on-money-high-frequency-trading-and-the-centering-of-the-financial-periphery-from-volume-32/)

For more than a decade, algorithmic trading has been regarded by some as 'rigging markets' and un-leveling the playing field. Regulators have been tempted to address these elements, but so far no substantial interventions have taken place. As such, fundamental critique of the passive and algorithmic dynamics seems to remain a somewhat academic exercise (https://hiddenforces.io/podcasts/mike-green-passive-investing/).

As a whole, the dynamic momentum within the financial sector has become so complex and strong, that regulatory bodies are not only left unable to understand them but also unable to curb excessive aspects (both at the systemic and superficial level).

Apart from these systemic aspects, the economic value aspect has been decontextualized from the real economy: financial jobs have mostly become so-called 'bullshit-jobs', since they only provide value strictly within the context of the financial sector, not in the real economy.

This bullshit-job phenomenon today spans a huge part of our economy, as is described perfectly by David Graeber. As such, compared to, say, 100 years ago, todays economy is mostly a bullshit economy. Most energy-consumption is transformed more and more into excessive pollution of both the real world and the digital world, while providing only more meaningless value. Ever more data-centers to handle ever more noise. Even where generative AI is supposed to increase efficiency, the peripheral noise it yields totally dwarfs the incidental, anecdotal actual value of this efficiency gain.

It does not seem possible to reverse this trend. Initiatives like ESG-investing, the Bitcoin-protocol, MiFIDs and all kinds of offsetting-markets only seem to add to this dynamic. In fact, in trying to fight bullshit, we actually end up introducing even more bullshit.

As unwanted as this trend is, and as much we are (still only anecdotally) trying to fight it, there is a fundamental, natural logic behind this trend:

from a systemic point of view, a bullshit economy is the current path of least resistance for 'the system' to dissipate its given energy.

As such, the over-abundance of complexity in the system provides a growing space for new 'lazy' paths for energy to pass through.

And every day we are effectively adding to this complexity.

Sweaty bullshit

Next to the obvious and well-known negative psychological and social impact of increasing loss of a sense of purpose, this bullshit-economy is damaging in other ways as well. The metabolic analogy would be one of a meth-driven high, which speeds up certain processes in ways that the rest of the body cannot handle. In an effort to cool down, it sweats as much as possible, as fast as possible. For our economic system this sweat looks like environmental pollution and erosion: it sweats plastics, e-waste, cheap clothing, it erodes land and resources, etc. This sweats follows the paths of least resistance.

And it sweats money.

Economic growth today is not real growth, it is just the system finding new sweaty paths of lesser resistance within the complexity of its infrastructure. It sweats money according to the changing paths of least resistance.

Increase friction

and reduce complexity

There is a growing and excellent body of material on degrowth/post-growth available for anyone looking for answers to our damaging runaway economic metabolism.

But from this systemic, metabolic point of view, an intervention would obviously target the excessive level of complexity and the excessive efficiency it facilitates. It would find areas where transactional friction has become almost absent, and increase friction again. It is possible to increase aggregate transactional friction again, targeted to impact the most bullshitty and damaging aspects first and leave healthy aspects completely untouched.

Instead of trying to regulate the autonomy of these dynamics, a systemic intervention would try to reduce this autonomy by gradually disabling it. It would reduce the bullshit-accellerant.